The formal letter from the committee coordinator Professor Malek is here.

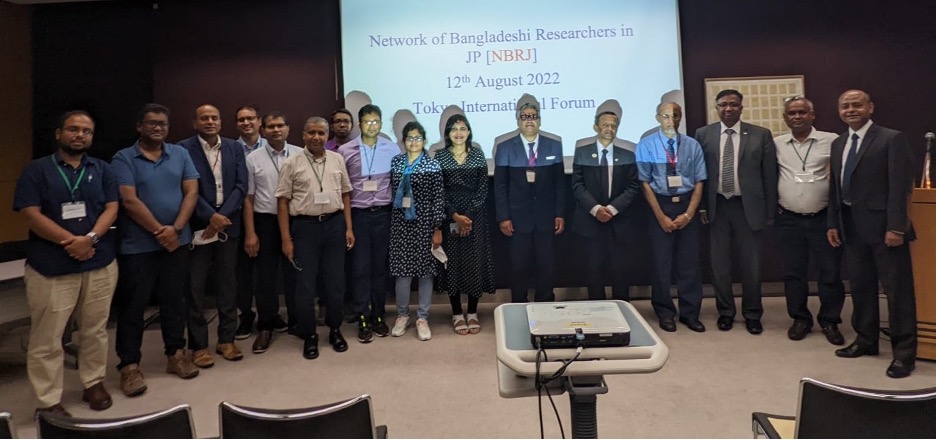

A network of Bangladeshi (origin) Researchers in Japan (NBRJ), with about 60 members of faculties and researchers of Bangladeshi (origin) working in Japanese universities, research institutes, and industries, was formally kicked off by its first in-person flagship annual event, multidisciplinary research workshop at 50 years of Bangladesh, in Tokyo International Forum, Tokyo on 12 August 2022. The network was initiated earlier by a zoom-based network meeting on 12 March 2021 during the Covid 19 pandemic.

The NBRJ sets a vision to be known as the leading research and policy advocacy group in Japan with interdisciplinary research skills dedicated to informing and leveraging the development of Bangladesh through promoting Japan-Bangladesh scientific and development cooperation, intellectual engagement, and policy advocacy. We gradually envision symbiosis (共生) and coexistence (共存) with Japanese researchers and research bodies that have similar interests and goals.

At its annual event, the general meeting with about 30 members is organized, and a working committee is formed and planned to formulate its bylaws, complete society registration, and like. It is also planned that the second annual flagship workshop will be held in August 2023 at Nanzan University, Nagoya, to be chaired by Professor Khondakar Mizanur Rahman.

In its first multidisciplinary workshop, about 18 papers on Bangladesh issues were presented in four major disciplines, namely 1) Business, Humanities, and Social Science, 2) Agricultural Science, 3) Medical, Pharmaceuticals, and Public Health, and 4) Natural Sciences, Engineering, and ICT. In addition, a workshop proceeding compiling all abstracts is published, and a book with extended abstracts has been planned for wider circulation and dissemination. Professor Sharifu Ura at Kitami Institute of Technology chaired the 2022 multidisciplinary research workshop.

The two days event was formally concluded by the Ambassador of Bangladesh to Japan, H.E. Mr. Sahabuddin Ahmed.